The Greatest Guide To Paul B Insurance Medicare Agent Near Me

Table of ContentsThe Definitive Guide to Paul B Insurance Medicare Agent Near MeSome Known Incorrect Statements About Paul B Insurance Medicare Advantage Plans Indicators on Paul B Insurance Best Medicare Agent Near Me You Need To KnowThe 45-Second Trick For Paul B Insurance Best Medicare Agent Near MeSome Known Details About Paul B Insurance Medicare Agent Near Me All about Paul B Insurance Medicare Advantage Plans4 Easy Facts About Paul B Insurance Medicare Advantage Plans Explained

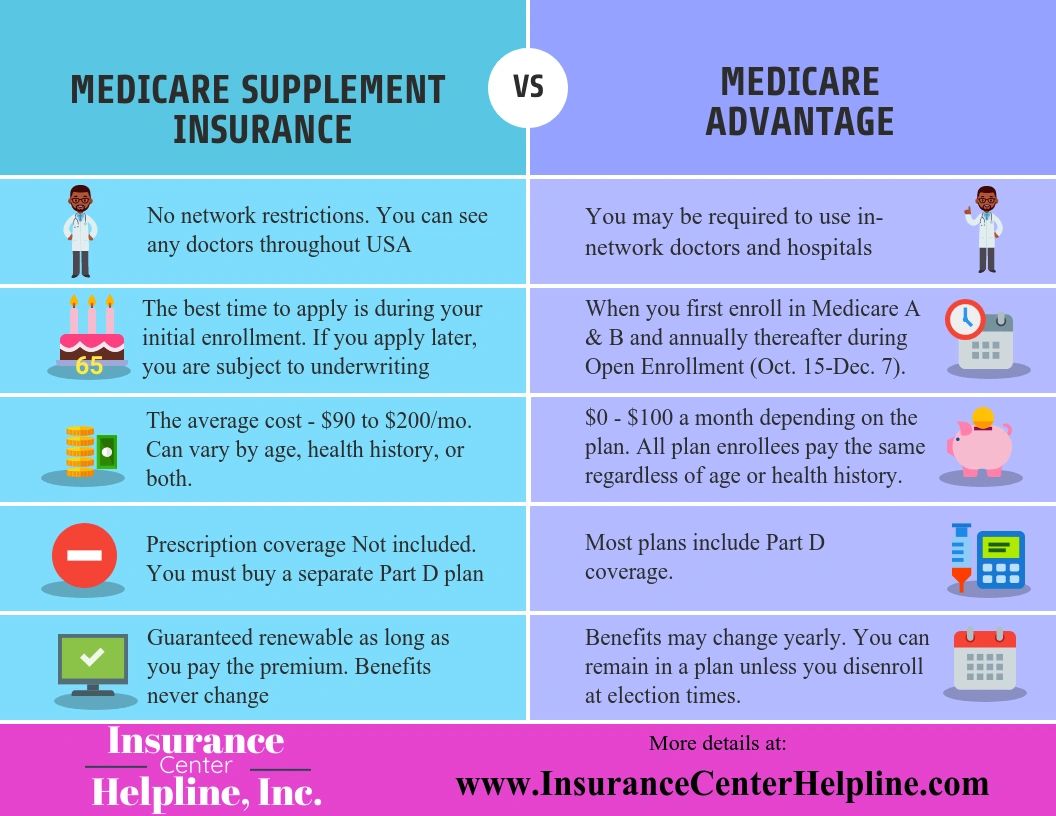

Be sure that you understand the extra advantages and any advantages (or flexibilities) that you might lose. You may wish to think about: If you can change your present doctors If your medications are covered under the plan's formulary (if prescription drug coverage is offered) The month-to-month premium The cost of protection.What extra services are used (i. e. preventive care, vision, dental, health club membership) Any treatments you need that aren't covered by the plan If you desire to enlist in a Medicare Advantage strategy, you must: Be eligible for Medicare Be registered in both Medicare Part A and Medicare Part B (you can check this by describing your red, white, and blue Medicare card) Live within the plan's service location (which is based upon the county you live innot your state of home) Not have end-stage kidney illness (ESRD).

"When people first go on Medicare, they're generally reasonably healthy and not thinking necessarily about when they're sick and what type of plan would be best for them in that scenario. The inability to quickly switch back and forth in between Medicare Advantage and Medicare Supplement makes it quite complicated for individuals," she says.

The Main Principles Of Paul B Insurance Medicare Part D

While Medicare Advantage can be a cheaper option to getting Plans A, B and D independently, it likewise includes geographical and network limitations and, sometimes, surprise out-of-pocket expenses. By discovering more about the pros and cons of Medicare Advantage, you can discover the best Medicare Advantage supplier for your requirements.

These can include only working with the business's network of suppliers or requiring to supply a doctor's referral prior to seeing a professional (Paul B Insurance Medicare Agent Near me). Depending upon which business you work with, you may be confronted with a limited selection of suppliers and a small overall network. If you require to receive care outside this network, your expenses may not be covered.

Evaluation the most commonly asked questions about Medicare Benefit plans below to see if it is right for you. Paul B Insurance Medicare Part D. BROADEN ALL Medicare Advantage plans consolidate all Original Medicare benefits, consisting of Parts A, B and generally, D. In other words, they cover whatever an Original Medicare strategy does but may include geographical or network limitations.

About Paul B Insurance Medicare Agent Near Me

This is finest for those who take a trip often or desire access to a broad range of suppliers. Original Medicare comes with a coinsurance of 20%, which can lead to high out-of-pocket expenses if your approved Medicare amount is considerable. On the other hand, Medicare Advantage strategies have out-of-pocket limitations that can guarantee you invest just a particular quantity before your coverage starts.

They are definitely not an excellent fit for everybody. We are here to clarify why these apparently too-good-to-be-true plans have a less-than-stellar credibility. There are several reasons that beneficiaries might feel Medicare Benefit plans are bad. Some insurance policy holders can offer a list of drawbacks, while others might be satisfied with their Medicare Advantage coverage.

Since not all physicians accept Medicare Benefit plans, it can be challenging to discover the right physician who takes your strategy, leading to a delay in care. The most significant misconception about Medicare Benefit plans is that they are totally free.

Not known Details About Paul B Insurance Medicare Supplement Agent

Unfortunately, there is no such thing as a totally free Medicare strategy. The main reason that Medicare Benefit providers can provide low to zero-dollar month-to-month premium plans is that Medicare pays the personal companies supplying the strategies to take on your health threat. However not all Medicare Benefit plans have a low premium expense.

Medicare Benefit prepares frequently offer extra benefits that you won't find on a Medicare Supplement plan. These additional advantages can trigger issues when paying pop over here for the services (Paul B Insurance Medicare Agent Near me).

The average doctor is not a fan of Medicare Advantage since these strategies put the clients' monetary threat in the hands of the medical professional. The Medicare Advantage plan carrier will pay the medical professional a set quantity of money upfront based on the client's medical diagnosis. So, the only way the doctor will earn a profit is if they stay under budget.

Paul B Insurance Best Medicare Agent Near Me - Truths

The value of a Medicare Benefit plan depends upon your location, healthcare needs, budget, and preferences. So, for some, a Medicare Advantage plan might be an excellent financial investment. If you do not frequently attend doctors' consultations and remain in great health, you could end up getting more out of the strategy than you put in.

Merely, Medicare Advantage strategies are great up until they are no longer this link helpful for you. If you enlist in a Medicare Benefit plan now, you might be able to cancel your Medicare Benefit plan and register in a Medicare Supplement (Medigap) strategy in the future. To do so, you will need to wait until the Annual Registration Duration or the Medicare Advantage Open Enrollment Duration to make modifications.

This is your only chance to enlist in a Medigap strategy without answering health concerns. If you miss this one-time chance to enlist, you will need to address health concerns should you wish to register in a Medicare Supplement plan in the future. This implies the provider could deny your application due to pre-existing conditions.

The Facts About Paul B Insurance Medicare Agent Near Me Uncovered

The carriers submit their quote based upon expenses per enrollee for medical services Original Medicare covers. Expect the bid is higher than the benchmark amount. In that case, the enrollee will pay the distinction in the type of month-to-month premiums, which is why some Advantage strategies have a zero-dollar premium and others have a month-to-month premium.

What is the worst Medicare Advantage strategy? The most limiting Medicare Benefit plan in regards to protection, network, and reliability would be an HMO strategy. Nevertheless, the worst Medicare advantage Resources plan for you might not be the worst for somebody else. If you choose to enlist in a Medicare Advantage plan, you require to ensure that your doctors and medical facility will be covered as well as a low optimum out-of-pocket limitation.

Get This Report on Paul B Insurance Best Medicare Agent Near Me

What is Medicare Advantage? What are the benefits and limitations of Medicare Benefit plans? Exist any securities if I enlist in a strategy and do not like it? Are any Medicare Managed Care Plans offered where I live? Medicare Advantage expands health care alternatives for Medicare recipients. These options were created with the Well balanced Spending Plan Act of 1997 to decrease the development in Medicare costs, make the Medicare trust fund last longer, and give recipients more options.

It is essential to remember that each of these alternatives will have benefits and constraints, and no option will be right for everyone. Also, not all choices will be available in all areas. Please Note: If you do not actively choose and enroll in a new strategy, you will stay in Original Medicare or the original Medicare managed care strategy you presently have.

Initial Medicare will constantly be readily available. This is a handled care strategy with a network of suppliers who contract with an insurance coverage business.